Running a small business is no small feat—and staying compliant with ever-evolving tax regulations can be one of the biggest stressors business owners face.

At Rae’s Accounting, we talk with entrepreneurs every day who feel like they’re navigating a tax maze without a map. Here are the top tax concerns we see keeping small business owners up at night—and what you can do about them.

1. Uncertainty About Estimated Taxes

Many small business owners aren’t sure how much they should be paying in quarterly estimated taxes—or when to pay them. Missed payments or incorrect calculations can lead to penalties and interest that snowball fast.

2. Confusion Over Deductions

From home office deductions to vehicle use, many small business owners worry they’re either missing out on valuable deductions or taking ones that could trigger an audit.

3. 1099 & Payroll Classification Errors

Classifying a worker as a contractor instead of an employee—or vice versa—can lead to audits and major back taxes. So can skipping 1099s entirely.

4. DIY Bookkeeping Mistakes

It’s tempting to save money by handling your books yourself, but miscategorized expenses, missed write-offs, and inconsistent recordkeeping can lead to costly tax prep—and even audits.

5. Falling Behind on Filings

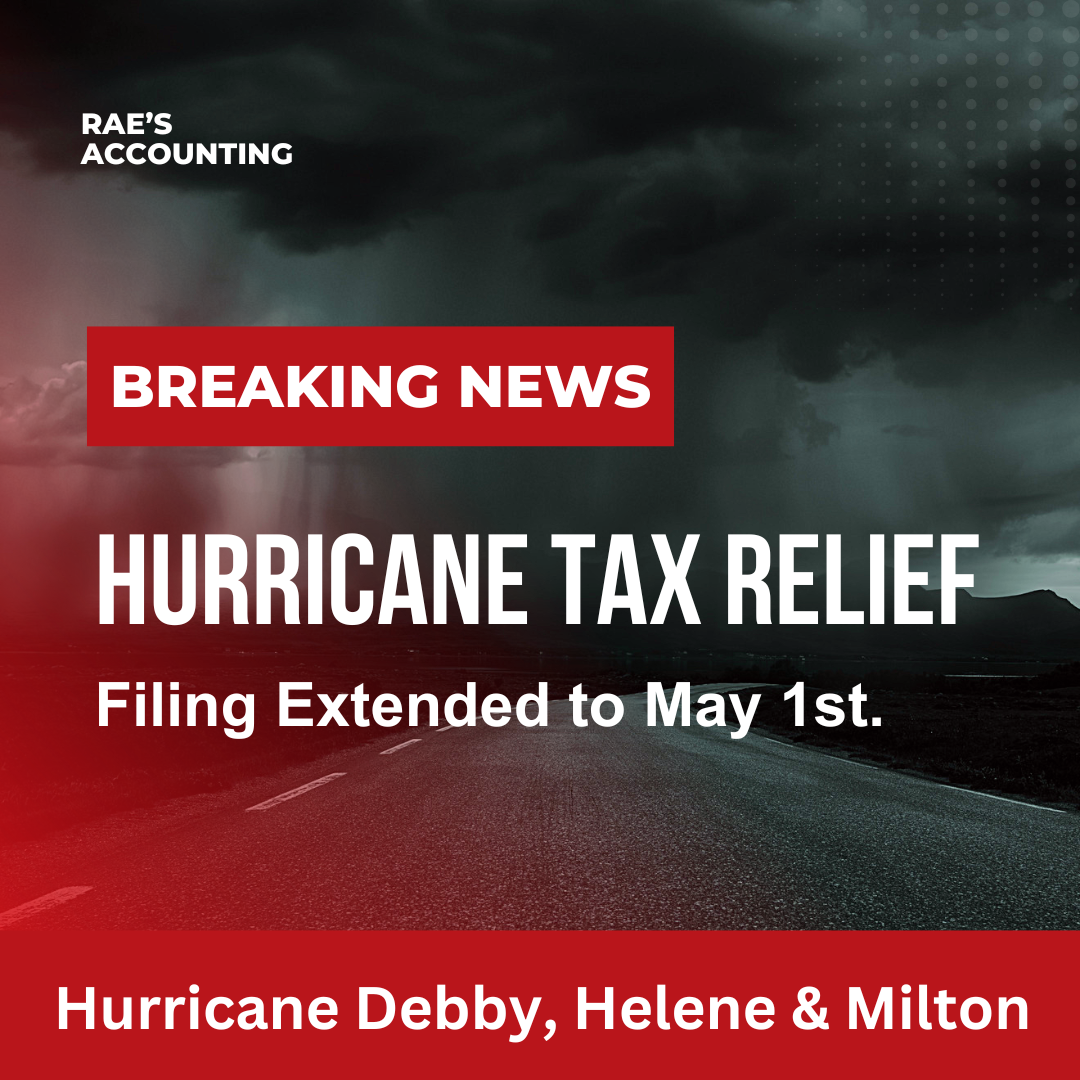

Late tax filings don’t just result in penalties—they can also hurt your business’s credit and reputation. And if you’re already behind, it can be hard to catch up.

You Don’t Have to Handle Taxes Alone

If any of these sound familiar, you’re not alone—and you don’t have to tackle it all by yourself. Rae’s Accounting offers personalized support, proactive planning, and an optional Tax Maintenance Program to keep you on track year-round.

1.png)

.png)

_large.png)