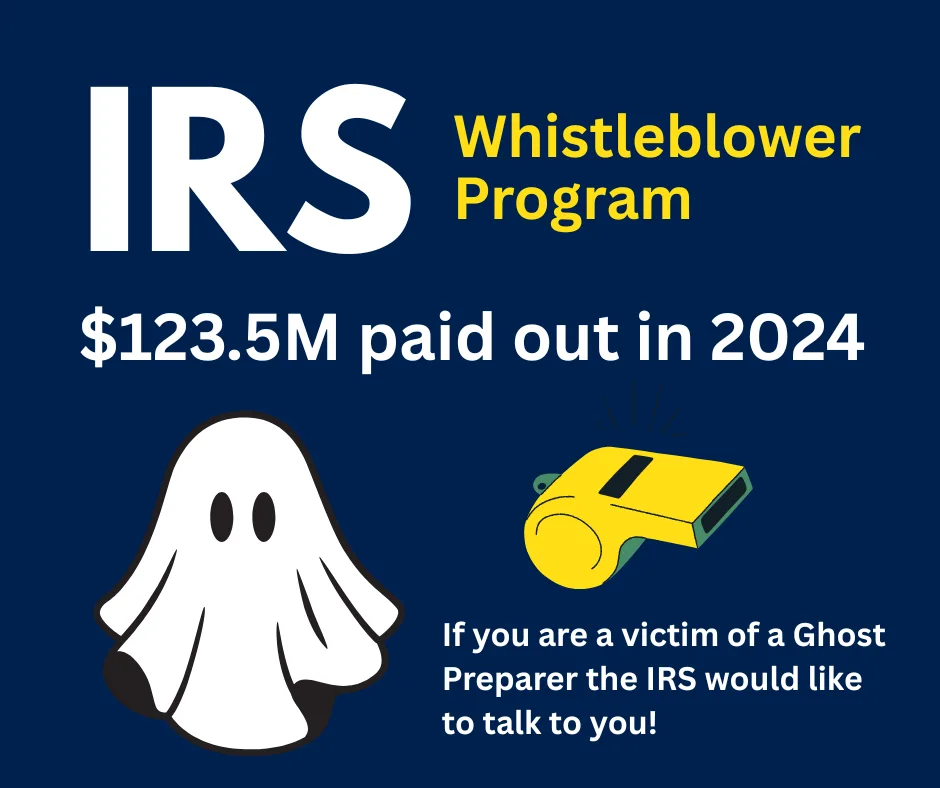

When it comes to taxes, the IRS isn’t just interested in collecting what’s owed—they’re also paying attention to the people who know when something’s not right.

And here’s the surprising part: if you blow the whistle on tax fraud, the IRS could actually pay you for it.

What Is the IRS Whistleblower Program?

The IRS Whistleblower Office was created to encourage people to report major tax fraud and evasion. If you provide credible, original information that leads to the IRS collecting unpaid taxes, you may be entitled to an award.

In fact, in 2024 alone, the IRS paid out $123.5 million to whistleblowers, based on over $474 million in recovered funds. That’s not small change.

How Do You Qualify?

The program isn’t designed for small cases. Here’s what the IRS looks for:

-

Disputed proceeds must exceed $2 million

-

If you’re reporting on an individual, their gross income must exceed $200,000 in the relevant tax year

-

Your information must be specific, detailed, and actionable—not just a hunch or rumor

If the IRS takes action based on your tip, you could receive 15–30% of the collected amount.

Why Does This Matter to Business Owners?

Even if you never plan to file a whistleblower claim, this program is a reminder of how seriously the IRS takes compliance. If employees, partners, or competitors notice red flags in your business filings, they have a pathway to report it—and potentially profit from doing so.

That’s why keeping your financials clean and compliant isn’t optional. It’s protection.

How Rae’s Accounting Helps

At Rae’s Accounting, our goal is to keep you on the safe side of IRS attention. We:

-

Help you build airtight systems to prevent reporting errors

-

Ensure your filings are accurate and compliant

-

Provide proactive tax strategy that eliminates costly risks

Because when the IRS comes calling, you want to be confident there’s nothing to hide.

Bottom Line

Yes, the IRS pays whistleblowers—and in some cases, it pays them very well. But instead of worrying about someone blowing the whistle on you, work with professionals who keep your business above board from the start.

? Have questions about compliance or your tax situation? Schedule a consult with Rae’s Accounting today.