When business owners think about tax challenges, the focus is often on one question: How much do I owe?

But in today’s tax environment, the true burden goes far beyond the final number on a return. Modern businesses are navigating a tax landscape that is constantly shifting—one that requires ongoing attention, planning, and strategy to manage effectively.

Here are the real tax burdens businesses face today—and why addressing them requires more than once-a-year tax preparation.

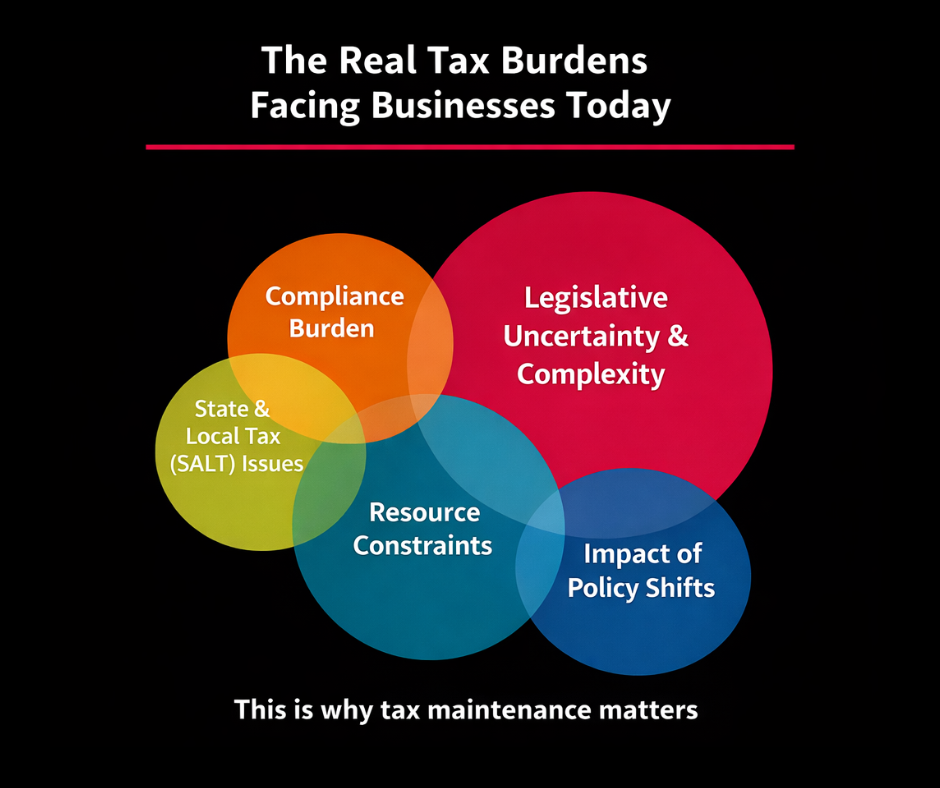

Legislative Uncertainty & Complexity

Tax laws are no longer static. New incentives, phase-outs, and expanded rules around bonus depreciation, research and development credits, and energy-related credits are introduced regularly.

While these changes can create opportunities, they also make planning far more complex. Decisions made early in the year can have unintended consequences if the rules change mid-stream—or if opportunities are missed entirely because no one was watching closely enough.

Without ongoing guidance, businesses are often reacting instead of planning.

Compliance Burden

Compliance is one of the most resource-intensive challenges businesses face.

Federal, state, and local requirements continue to grow—particularly around employment taxes, sales tax collection, and nexus rules. Each layer adds time, paperwork, and risk.

Missing a filing, underpaying a tax, or misunderstanding a requirement can lead to penalties, interest, and unnecessary stress. And for many businesses, keeping up feels like a full-time job on its own.

State & Local Tax (SALT) Issues

As businesses expand—whether across state lines or through online sales—state and local tax obligations become increasingly complex.

Evolving nexus standards and differing state tax structures mean that compliance in one state may look very different in another. What worked last year may no longer apply today.

SALT issues are often overlooked until they become a problem, at which point cleanup is far more difficult and costly.

Impact of Policy Shifts

Legislation like the One Big Beautiful Bill (OBBBA), along with future policy changes tied to elections and economic conditions, can directly affect deductions, credits, and even business structure decisions.

These shifts don’t just impact large corporations. Small and mid-sized businesses feel the effects quickly—often without enough notice to adjust properly.

Proactive planning is the difference between adapting smoothly and scrambling after the fact.

Resource Constraints

Most businesses aren’t short on ambition—but they are short on time, staff, and systems.

Internal teams are stretched thin. Technology may be outdated. Strategic tax planning often falls to the bottom of the priority list, simply because there’s no capacity left to address it.

That doesn’t make tax strategy less important—it makes it easier to miss.

Why Year-Round Tax Maintenance Matters

These tax burdens don’t appear once a year during filing season. They exist year-round.

That’s why effective tax planning isn’t a one-time event—it’s an ongoing process.

Rae’s Accounting’s Tax Maintenance Program is designed to help businesses stay informed, compliant, and strategically aligned throughout the year. By monitoring changes, reviewing the numbers regularly, and adjusting plans as needed, businesses gain clarity instead of surprises.

Tax maintenance isn’t about reacting to problems.

It’s about staying ahead of them.

The Bottom Line

The real tax burden isn’t just what you pay—it’s the complexity, uncertainty, and pressure of navigating a constantly changing system without support.

With the right strategy in place, tax planning becomes less stressful, more predictable, and far more effective.

📊 This is why tax maintenance matters.

1.png)

.png)

_large.png)